IRS Tax Lien

Don’t Let it Hold You Back!

Facing an IRS tax lien can be gut-wrenching. Don’t let a tax lien hold you back from financial stability. Our team is ready to provide swift, professional assistance to resolve your tax lien issues, safeguard your assets, and restore your peace of mind. Take the first step towards a brighter future.

Understanding in Detail: What is an IRS Tax Lien?

So, how does an IRS tax lien affect you?

Once the IRS files a tax lien, it may limit your ability to get credit, and it attaches to all your current assets and future assets acquired during the duration of the lien. Moreover, an IRS tax lien may appear on your credit report, making it challenging to obtain new credit or loans.

But here’s the critical question: Can you get rid of an IRS tax lien? Absolutely.

The process of IRS tax lien removal begins once the tax debt is paid in full. However, there are other ways to address it even if you can’t pay the full amount immediately. This is where negotiation and settlement options like an Offer in Compromise or installment agreements come into play, potentially leading to the withdrawal of the lien. However, many people find the application process and dealing with the IRS directly to be frightening!

Concerned about an IRS tax lien on your property?

Our Process

How do we Approach your IRS Tax Lien?

Initial Consultation

We start with a thorough discussion to understand your specific situation and the details of the IRS tax lien. This step is crucial for us to tailor our approach effectively.

Step : 02

Our team conducts a comprehensive review of your financial status. We analyze your assets, liabilities, and overall financial health to strategize the best course of action.

Step : 03

Depending on your situation, we explore various options like setting up payment plans, negotiating an Offer in Compromise, or other IRS relief programs that could lead to the removal of the tax lien.

Step : 04

Implementing the Action Plan

Once we determine the most viable solution, we put the plan into action. This may involve negotiating with the IRS, completing necessary paperwork, and ensuring compliance with all tax laws.

Step : 05

Monitoring and Adjusting Strategy as Needed

As we work through the process, we continuously monitor progress and make necessary adjustments. Our aim is to efficiently move towards the removal of the tax lien.

Step : 06

Final Resolution and Follow-up

After resolving the lien, we don’t just stop there. We provide ongoing advice and support to help you maintain tax compliance and prevent future tax issues.

We understand the stress and burden an IRS tax lien can bring to your life. Let us help you lift the burden of a tax lien and guide you toward a more promising financial future. Get in touch today.

Michael Sullivan

Fox and ABC News Contributor

Learn in Depth: How to Remove an IRS Tax Lien?

If you’re unable to pay in full, consider an installment agreement. Once you’re in compliance and certain conditions are met, you can request the IRS to withdraw the lien.

Demonstrating that the lien is hindering your ability to pay the debt, the IRS may consider withdrawing the lien.

This is just another avenue that can help resolve the situation. Tax liens generally last for ten years, after which the IRS must release the lien.

If you believe the tax lien was filed in error, you can appeal to the IRS for its removal.

Book a discovery call to take the first step to relief.

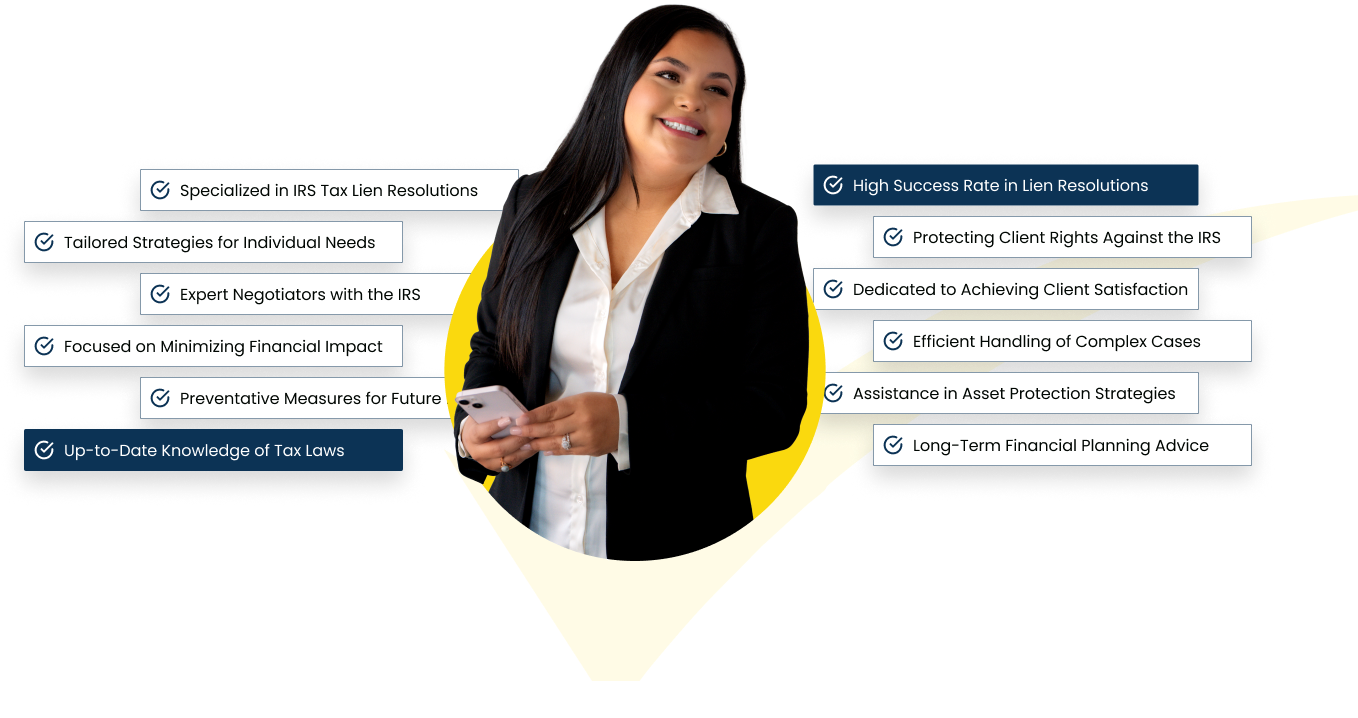

Why should you Partner with us?

What's

our clients says

Robert Clarkson

The day I received a notice about an IRS tax lien, I felt my world was crashing down. Sara helped me during these times, managing to lift the lien and reduce my owed amount by 35%. She saved our finances. Big thanks to her.

The day I received a notice about an IRS tax lien, I felt my world was crashing down. Sara helped me during these times, managing to lift the lien and reduce my owed amount by 35%. She saved our finances. Big thanks to her. Frequently Asked Questions

Don’t ignore it. You have the right to appeal within 30 days of the notice. Get in touch with our tax professionals, who can help you understand your options and the best course of action.

Yes, liens can be removed through payment in full, setting up a payment arrangement that satisfies the IRS, or through measures like a lien withdrawal, discharge, or subordination.